E-Invoicing in Malaysia: How Payment Gateways Fit In

- 首页

- Payments & Fintech

- E-Invoicing in Malaysia: How Payment Gateways Fit In

免责声明: This article is for general informational purposes only and does not constitute tax, legal, or professional advice. e-Invoicing requirements in Malaysia may change and vary by business size and industry. Businesses should consult LHDN guidance or qualified advisors and verify system requirements with their service providers before making compliance decisions.

Malaysia’s move toward mandatory e-Invoicing is not just a tax change. For many SMEs, it forces a rethink of how payments, records, and compliance fit together.

One of the most common points of confusion is the role of payment gateways. Many business owners assume that a payment receipt, FPX confirmation, or card settlement report automatically counts as an invoice. In practice, this assumption creates compliance gaps that only surface during audits or system integration.

This guide explains how e-Invoicing works in Malaysia, where payment gateways fit into the process, and what SME owners should prepare before enforcement tightens.

What is e-Invoicing in Malaysia (in Simple Terms)

E-invoicing refers to the electronic issuance, transmission, and storage of invoices in a structured digital format that can be validated by tax authorities.

In Malaysia, e-Invoicing is administered by Lembaga Hasil Dalam Negeri Malaysia, commonly known as LHDN.

At its core, an e-Invoice must:

- Be generated by the seller

- Contain mandatory tax and transaction fields

- Be transmitted to LHDN’s system for validation

- Be stored in a compliant digital format

An e-Invoice is not simply a PDF, receipt, or payment confirmation.

Do Payment Gateway Receipts Count as e-Invoices?

Short answer: No.

Payment gateway receipts serve a different purpose.

What a Payment Gateway Receipt is

A gateway receipt or confirmation shows that:

- A payment was attempted or completed

- Funds were authorised or settled

- A transaction reference exists

It is proof of payment, not proof of tax reporting.

What an e-Invoice is

An e-Invoice represents:

- A tax document issued by the seller

- Revenue recognition

- Sales and Service Tax (SST) or tax reporting information

- Buyer and seller details in structured format

Even if a payment gateway issues a detailed receipt, the legal responsibility to issue an e-Invoice still sits with the business.

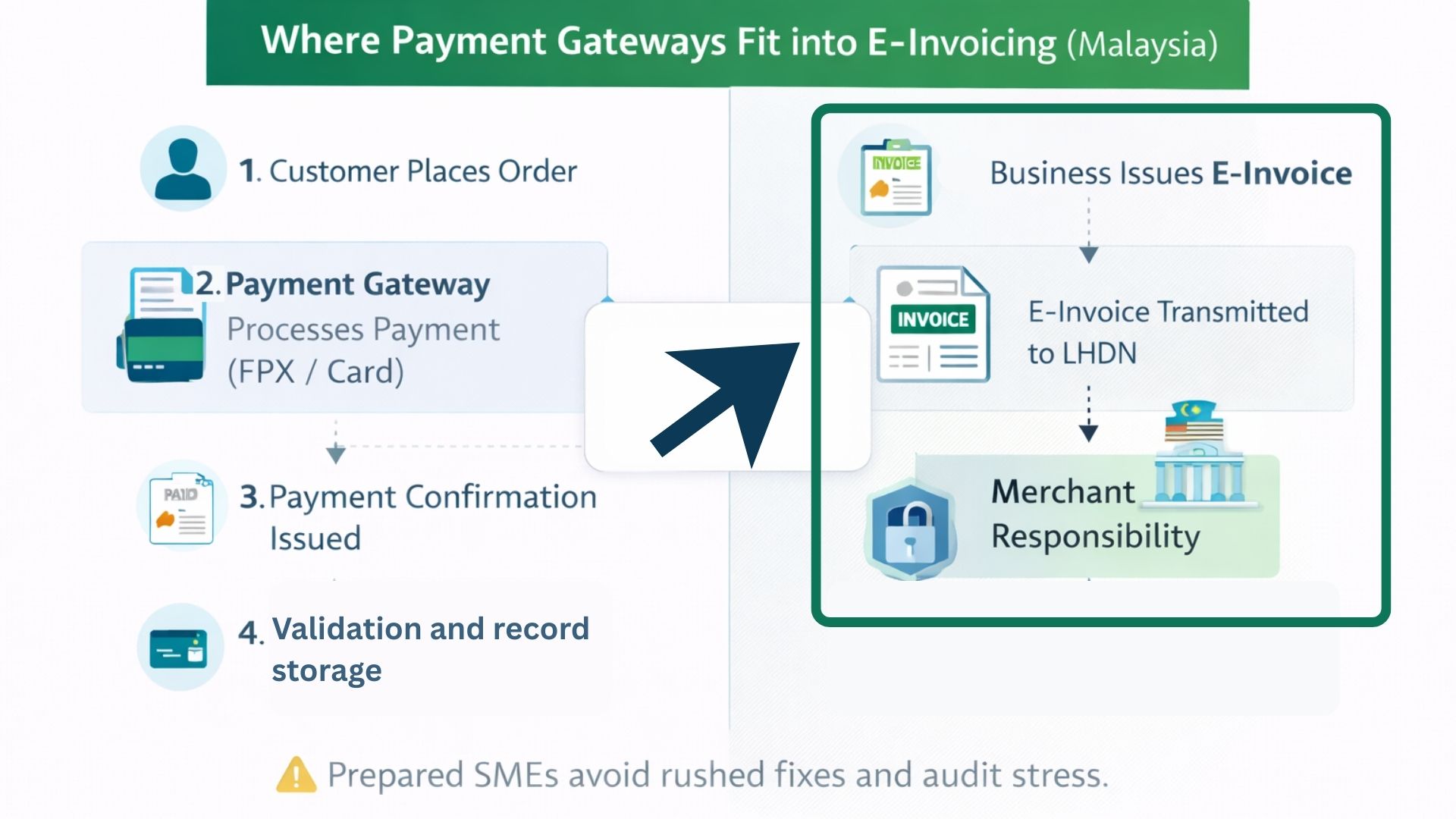

Where Payment Gateways Actually Fit in the e-Invoicing Flow

Think of payment gateways as one part of the transaction lifecycle, not the compliance layer.

A simplified workflow looks like this:

- Customer places an order

- Payment is processed via secure payment gateway

- Gateway confirms payment success or failure

- Business issues an e-Invoice

- E-Invoice data is transmitted to LHDN

- Records are stored for audit and reporting

The gateway supports step 2 and 3. The business remains responsible for step 4 onward.

This distinction is critical, especially as automation increases.

Common SME Mistakes Around e-Invoicing and Payment Gateways

Many compliance issues arise not from bad intent, but from misunderstanding.

Assuming “Paid” Equals “Invoiced”

Payment does not automatically create a valid invoice. Auditors and tax systems treat them as separate events.

Using Gateway Reports as Tax Records

Gateway dashboards are useful, but they are not designed to replace accounting or invoicing systems.

Manual Reconciliation at Scale

What works for 20 transactions a month breaks down at 2,000. Manual reconciliation increases error risk.

Ignoring Data Structure Requirements

E-invoicing requires specific fields. Missing or inconsistent data causes validation failures later.

How e-Invoicing Changes the Role of Your Payment Gateway

As e-Invoicing becomes mandatory, payment gateways are no longer just about collecting money. They influence:

- Data accuracy

- Transaction traceability

- Reconciliation speed

- Audit readiness

Payment gateways that provide:

- Clean transaction references

- Consistent settlement reports

- Structured data exports

Make e-Invoicing implementation significantly easier. Payment gateways that do not provide these may force SMEs to rely on manual workarounds.

Does Your Payment Gateway Affect Compliance Risk?

Indirectly, yes.

While the legal obligation to issue e-Invoices rests with the business, the quality of gateway data affects how smoothly compliance works.

Potential risk areas include:

- Inconsistent transaction IDs

- Delayed settlement records

- Limited reporting granularity

- Weak audit trails

Over time, these issues increase operational cost and compliance exposure.

This is why many established businesses prefer gateways built with compliance, reporting, and audit readiness in mind, rather than purely low transaction fees.

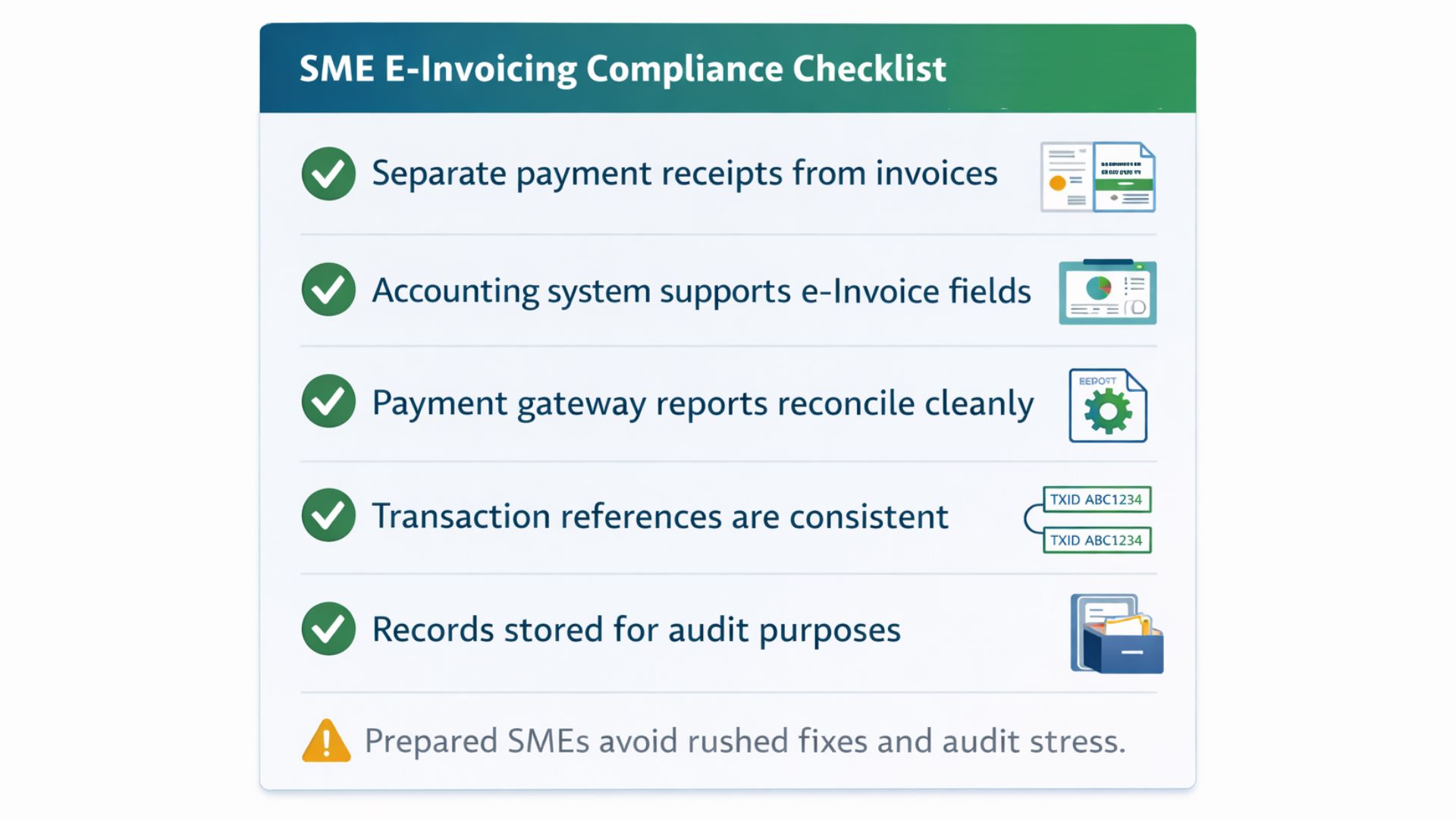

Preparing Your SME for e-Invoicing (Practical Checklist)

Before enforcement tightens, SME owners should ensure:

- Clear separation between payment confirmation and invoicing

• Accounting or invoicing software that supports e-Invoice data fields

• Payment gateway reports that reconcile cleanly with invoices

• Consistent customer and transaction records

• Internal processes documented for audits

This preparation reduces last-minute system changes and compliance stress.

免责声明: The information provided above is for general guidance only and should not be relied upon as a guarantee of full regulatory compliance. e-Invoicing requirements may vary based on business circumstances. SMEs are advised to consult LHDN or a qualified professional advisor for specific guidance.

How to Choose a Payment Gateway With e-Invoicing in Mind

When evaluating gateways today, SMEs should look beyond pricing and ask:

- Can I easily reconcile payments to invoices?

• Does the gateway provide structured, exportable transaction data?

• Will this setup still work when volume doubles?

• Who carries the compliance and data security responsibility?

These questions are explored in detail in choosing the right online payment gateway in Malaysia, especially for businesses planning to scale beyond basic FPX collections.

总结

E-invoicing in Malaysia is not just an accounting upgrade. It reshapes how payments, records, and compliance interact.

Payment gateways remain essential, but they are only one component of a compliant workflow. SMEs that understand this distinction early avoid rushed fixes, audit stress, and costly process changes later.

Preparing now means choosing systems that support growth, transparency, and compliance together, rather than treating each requirement as a separate problem.

FAQs About How Payment Gateway Fit Into e-Invoicing Workflow

Is e-Invoicing mandatory for all Malaysian SMEs?

E-Invoicing will be rolled out in phases in Malaysia. While not all SMEs are affected immediately, most businesses will eventually need to comply once enforcement applies to their category or turnover level.

Does a payment gateway receipt count as an e-Invoice?

No. A payment gateway receipt confirms payment only. An e-Invoice is a tax document issued by the seller and must meet LHDN’s structured data and validation requirements.

Who is responsible for issuing the e-Invoice, the gateway or the business?

The business is responsible. Payment gateways process payments but do not replace the seller’s obligation to issue compliant e-Invoices to customers.

Can e-Invoicing be automated if I use a payment gateway?

Yes, but only if your invoicing or accounting system integrates properly with payment data. The gateway alone does not automate e-Invoicing without supporting systems and processes.

Does my choice of payment gateway affect e-Invoicing compliance?

Indirectly. Gateways that provide clear transaction references, clean reporting, and structured data make reconciliation and e-Invoicing compliance much easier to manage.

What should SMEs prepare before e-Invoicing enforcement begins?

SMEs should review their invoicing workflow, ensure payment data can be reconciled accurately, and confirm that their systems can generate and store compliant e-Invoices for audit purposes.

我们的合作伙伴 :