How to Reduce Online Payment Failures: 10 Common Causes & Fixes

- 首页

- Payments & Fintech

- How to Reduce Online Payment Failures: 10 Common Causes & Fixes

Disclaimer: This content is for general informational purposes only and does not constitute legal, tax, accounting, or financial advice. Readers should consult qualified professionals for advice specific to their business circumstances.

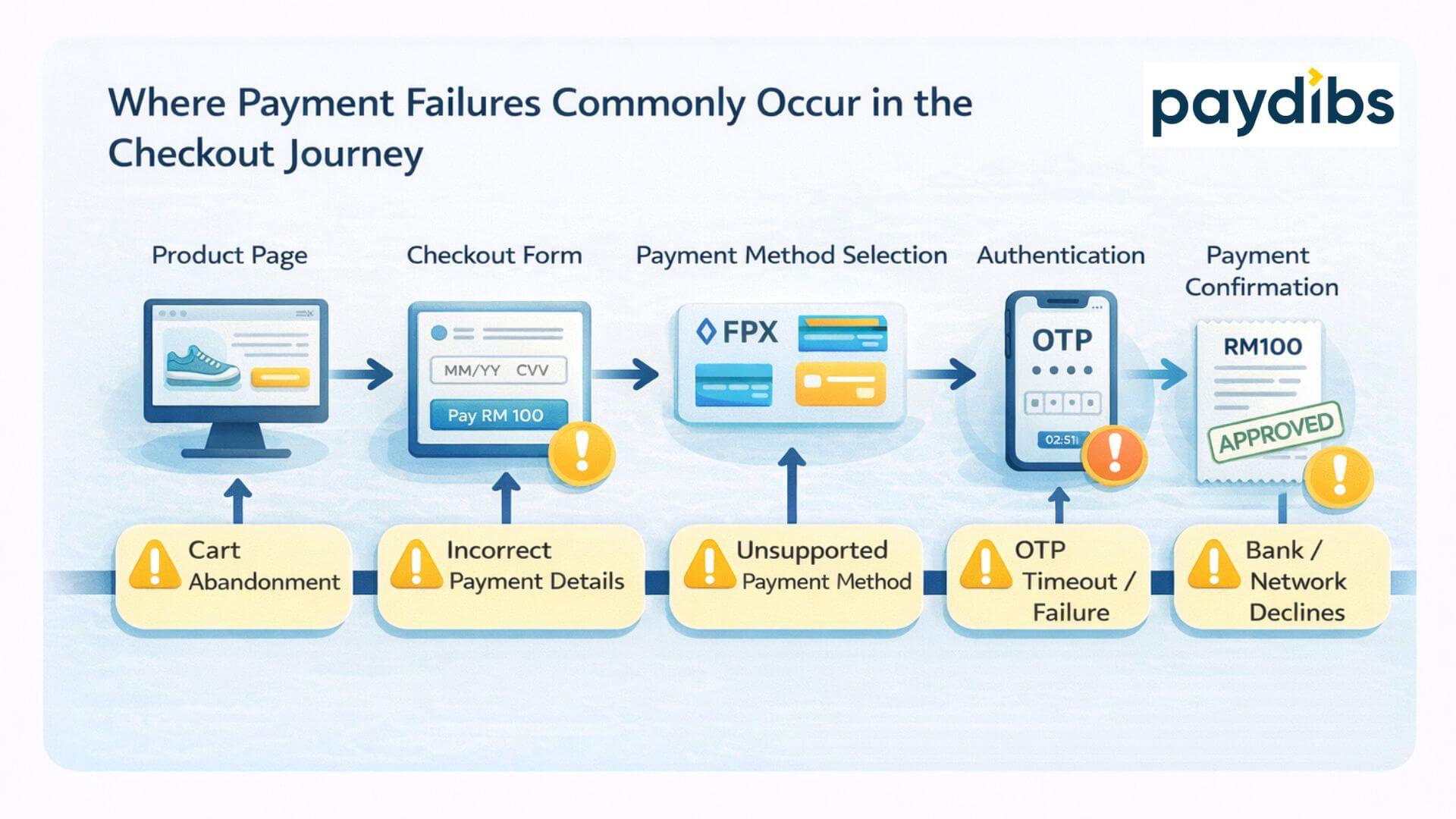

Online payment failures are rarely caused by a single issue. For most Malaysian Small and Medium Enterprise (SME)s, they happen at the intersection of customer behaviour, checkout design, payment method limitations, and gateway configuration.

While some failures are unavoidable, many are predictable and reducible with practical operational and User Experience (UX) changes, especially when merchants understand how FPX works. This guide is brought to you by Paydibs, a payment gateway in Malaysia for SMEs running online checkouts via cards, Financial Process Exchange (FPX), e-wallets, or Buy Now, Pay Later (BNPL). It breaks down ten common causes of payment failures and explains what businesses can do to reduce them, without requiring technical changes or deep engineering work.

Common Causes of Online Payment Failures in Checkout Flows

1. Incorrect Payment Details Entered by Customers

Why it happens

Customers mistype card numbers, expiry dates, CVV codes, or banking details, especially on mobile devices.

What you can fix

- Use input validation and auto-formatting

- Display clear field labels and examples

- Reduce the number of required fields

Small UX improvements here often lead to immediate reductions in failed payments.

2. One-Time Password (OTP) or 3D Secure Authentication Failures

Why it happens

Customers may:

- Miss OTP messages

- Switch apps mid-process

- Face delays or timeouts

This is common during peak hours or on unstable mobile connections.

What you can fix

- Add clear on-screen instructions explaining the OTP step

- Avoid auto-refreshing the page during verification

- Provide a visible “resend OTP” option if supported

Clarity reduces abandonment more than speed alone.

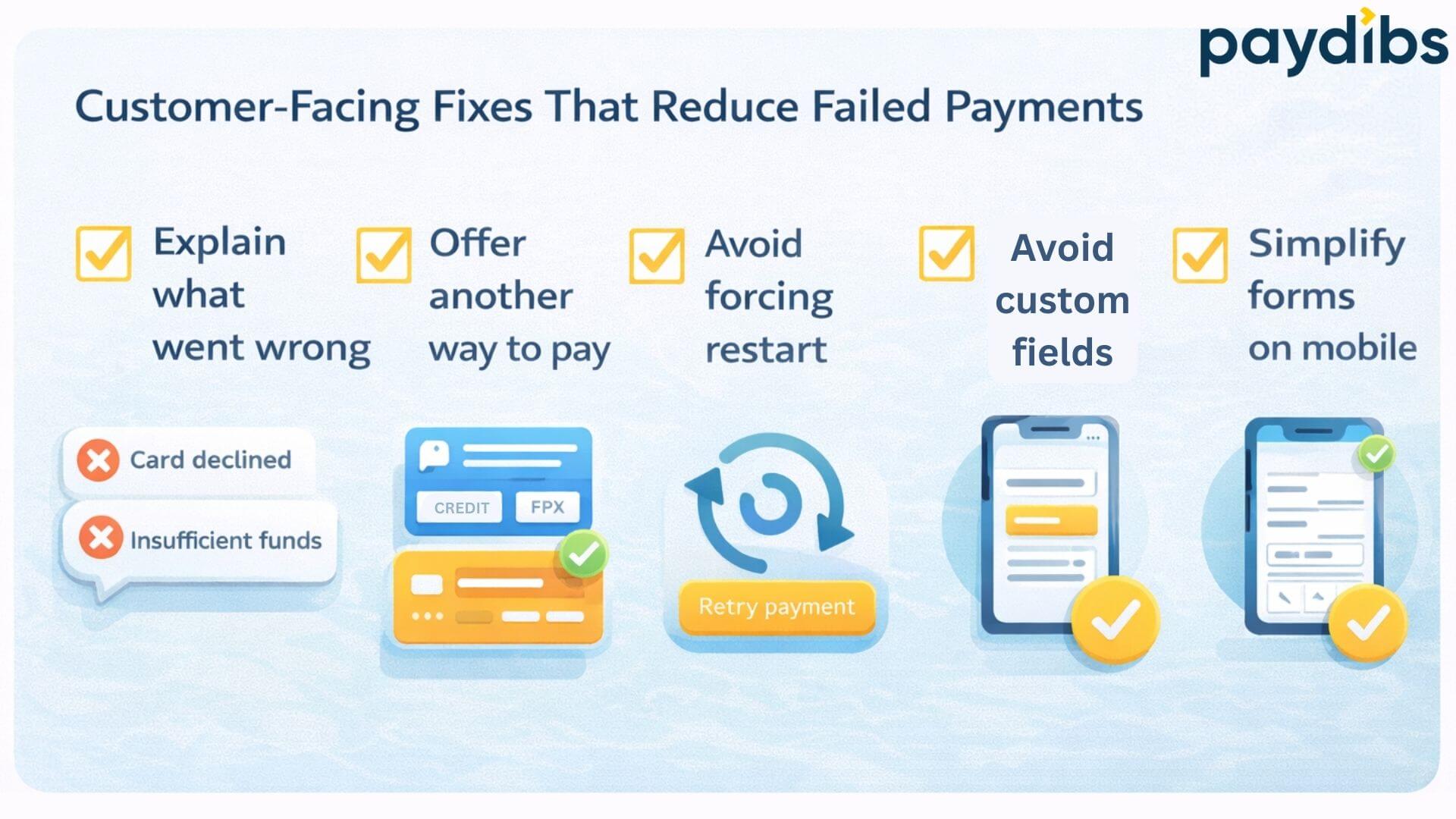

3. Insufficient Funds or Credit Limits

Why it happens

Customers attempt payments without checking balances or limits, particularly for BNPL or card payments.

What you can fix

- Offer alternative payment methods at checkout

- Allow customers to retry with a different method easily

- Avoid forcing a full checkout restart after failure

Giving customers options is more effective than error messaging alone.

4. Unsupported Payment Methods and Checkout Payment Issues

Why it happens

Customers select payment methods that are:

- Temporarily unavailable

- Not supported by their bank (for example, FPX participating banks)

- Restricted by region or eligibility

What you can fix

- Show only relevant payment methods based on context

- Grey out unavailable options with clear explanations

- Avoid generic “payment failed” messages

This reduces confusion and repeated failures.

5. Poor Mobile Checkout Experience and Failed Online Transactions

Why it happens

Most payment attempts happen on mobile, but many checkout flows are still desktop-first.

Common issues include:

- Small input fields

- Accidental navigation away from the page

- Slow page loads

What you can fix

- Simplify mobile checkout layouts

- Use large, tap-friendly buttons

- Minimise redirects where possible

A smoother mobile flow directly improves payment success rates.

6. Session Timeouts During Checkout

Why it happens

Long checkout processes or inactivity can cause sessions to expire before payment completion.

What you can fix

- Shorten checkout steps

- Display timeout warnings if sessions are limited

- Save cart and payment progress where possible

Customers are more likely to retry if they do not have to start over.

7. Temporary Bank or Network Disruptions

Why it happens

This is one of the most common causes of failed online transactions. Bank systems, FPX networks, or payment rails may experience brief outages or slowdowns.

What you can fix

- Encourage retries after short delays

- Display informative messages instead of generic errors

- Avoid framing these failures as customer mistakes

Transparency improves trust even when failures are external.

8. Confusing or Generic Error Messages

Why it happens

Many checkout systems default to vague messages like “Payment failed” or “Transaction declined”.

What you can fix

- Use specific, human-readable error messages

- Tell customers what they can do next

- Avoid technical jargon or blame-oriented language

Clear messaging reduces frustration and abandonment.

9. Too Many Checkout Steps or Distractions

Why it happens

Every additional step increases the chance of drop-off, especially during payment.

What you can fix

- Remove non-essential fields

- Delay upsells until after payment

- Keep customers focused on completing the transaction

Fewer decisions lead to higher completion rates.

10. Lack of Visibility Into Online Payment Failures

Why it happens

Many SMEs only notice failures when customers complain.

What you can fix

- Monitor failure rates by payment method

- Identify patterns such as time of day or device type

- Use this data to adjust checkout options and messaging

Awareness is often the first step to improvement.

How Payment Gateway Issues Contribute to Online Payment Failures

Payment gateway issues such as limited payment method support, unclear error messaging, or poor retry handling can increase online payment failure rates.

Different gateways offer varying levels of operational support, including:

- Payment method coverage

- Error visibility

- Retry handling

- Reporting clarity

These factors influence how easily businesses can identify and reduce online payment failures. This is one of the practical considerations discussed when choosing the right payment gateway in Malaysia, alongside pricing and integration factors.

Final Takeaway for SME Owners

Reducing online payment failures does not always require technical changes or new infrastructure. In many cases, they are experience and process issues that can be improved with clearer communication, better checkout design, and more flexible payment options.

By understanding the common causes and focusing on customer-friendly fixes, SMEs can reduce failed transactions, improve conversion rates, and create a smoother payment experience without major system changes.

FAQs About How to Reduce Payment Failures

What is considered an online payment failure?

A payment failure occurs when a customer attempts to complete a transaction but the payment does not go through successfully, resulting in no confirmation or settlement.

Are payment failures always caused by technical issues?

No. Many payment failures are caused by customer behaviour, unclear checkout design, payment method limitations, or external factors such as bank or network disruptions.

Which payment methods tend to fail more often?

Failure rates vary by context. Mobile payments, card transactions requiring OTP verification, and bank transfers during peak hours may experience higher failure rates if not supported by clear user guidance.

Can improving checkout design reduce payment failures?

Failure rates vary by context. Mobile payments, card transactions requiring OTP verification, and bank transfers during peak hours may experience higher failure rates if not supported by clear user guidance.

Should customers be allowed to retry payments after a failure?

Yes. Allowing easy retries and alternative payment methods helps recover transactions that might otherwise be abandoned after a single failure.

How can businesses identify the main causes of online payment failures?

Businesses can review payment failure patterns by payment method, device type, time of day, and error messages to identify recurring issues and prioritise improvements.

近期文章

- How to Reduce Online Payment Failures: 10 Common Causes & Fixes

- Paydibs – AltPayNet Partnership Advances Financial Connectivity and Inclusion Between Malaysia and the Philippines

- How to Record Payment Gateway Fees in Your Accounts (Malaysia Guide)

- Paydibs Strengthens Inclusive Innovation with Nexus E-Commerce Suite and Mini POS Feature for Malaysian MSMEs

- E-Invoicing in Malaysia: How Payment Gateways Fit In

我们的合作伙伴 :