SST Charge on Payment Gateway Fees in Malaysia

- 首页

- Payments & Fintech

- SST Charge on Payment Gateway Fees in Malaysia

Disclaimer: This article is for general informational purposes only and does not constitute tax, accounting, or legal advice. SST treatment may vary based on business circumstances and service arrangements. SMEs should refer to official SST guidance and consult qualified professionals to confirm their specific tax obligations.

For many Malaysian SMEs (Small and Medium Enterprise), payment gateway fees feel straightforward. You pay a transaction fee, record it as an expense, and move on.

In reality, SST (Sales and Services Tax) on payment gateway charges is one of the most common areas of confusion during audits and tax reviews, especially for businesses using a card payment terminal alongside online or card-based payment gateways. The issue is not usually underpayment, but misclassification, misunderstanding who bears the tax, and poor record keeping.

This guide explains when SST applies to payment gateway fees, how it typically appears in statements, and what SME owners should do to stay compliant as enforcement expectations continue to increase.

Is SST Charged on Payment Gateway Fees in Malaysia?

Under the Service Tax Act 2018 and the RMCD Guide on Financial Services, SST is imposed on fee-based financial services unless specifically exempted.

In practice, payment gateway providers typically charge merchants fees or commissions for facilitating payment acceptance. Where these charges constitute fee-based financial services, they are subject to SST.

Common examples of such fee-based charges include:

- Merchant discount rates (MDR) or transaction service fees

- Payment processing and transaction handling fees

- Settlement, reconciliation, and reporting fees

- Subscription, platform, or integration fees

- Fraud prevention, security, or risk-management services

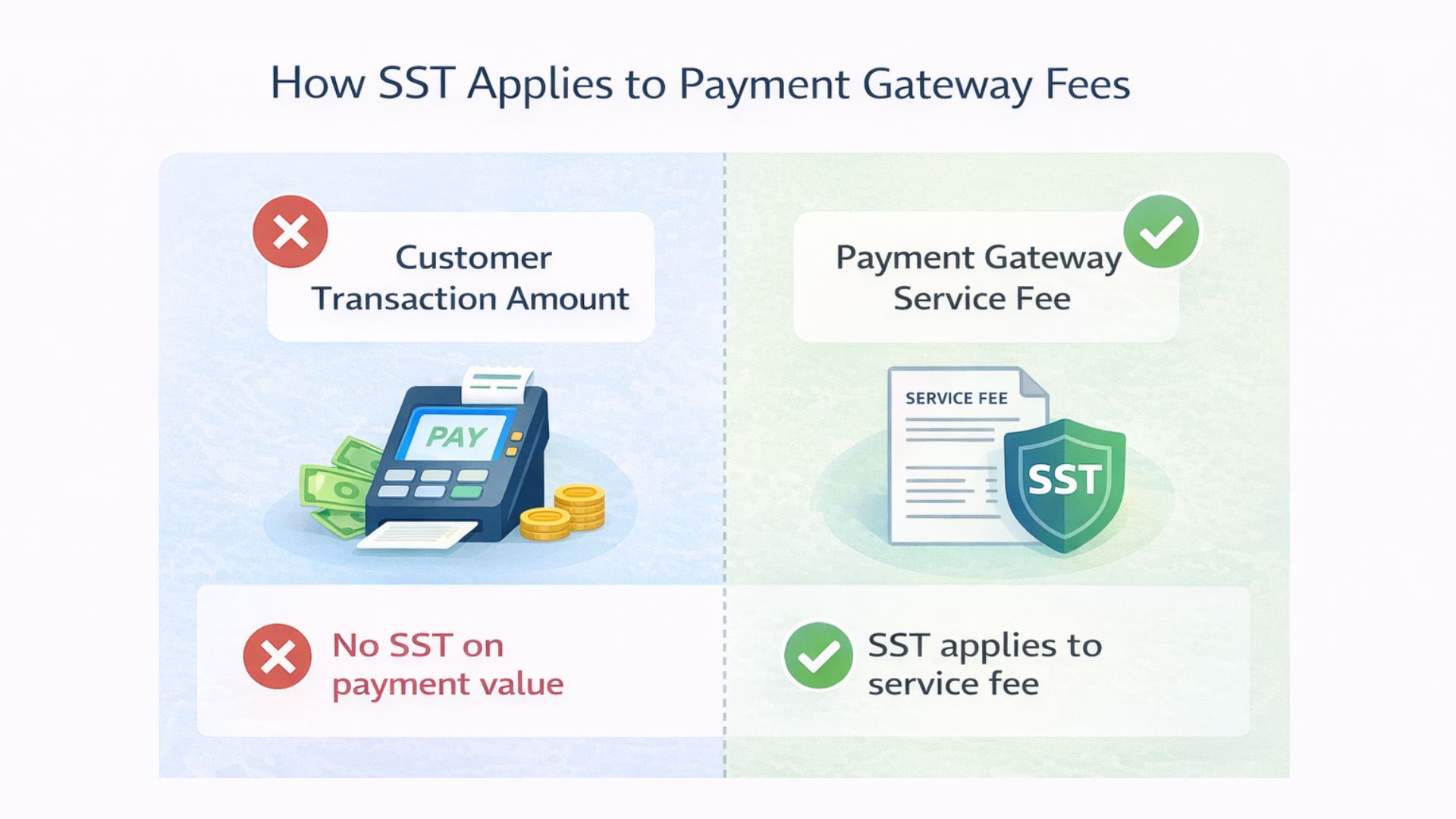

Importantly, SST is not charged on the transaction amount paid by the customer. The tax applies only to the service fee charged by the payment gateway, not the underlying sale value.

Certain basic payment or fund-transfer services may fall within exemptions under the RMCD Guide, but most merchant-facing gateway fees are fee-based services and therefore taxable.

Who Pays the SST, the Merchant or the Customer?

In most setups, the merchant bears the SST cost, not the customer.

Payment gateway fees are typically:

- Charged to the SME

- Treated as a business expense

- Inclusive or exclusive of SST depending on the provider

Unless the fee is explicitly passed on and disclosed, SST on gateway services is absorbed by the business as part of operating costs.

This is why SST treatment must be reflected correctly in accounting records, even though customers never see it.

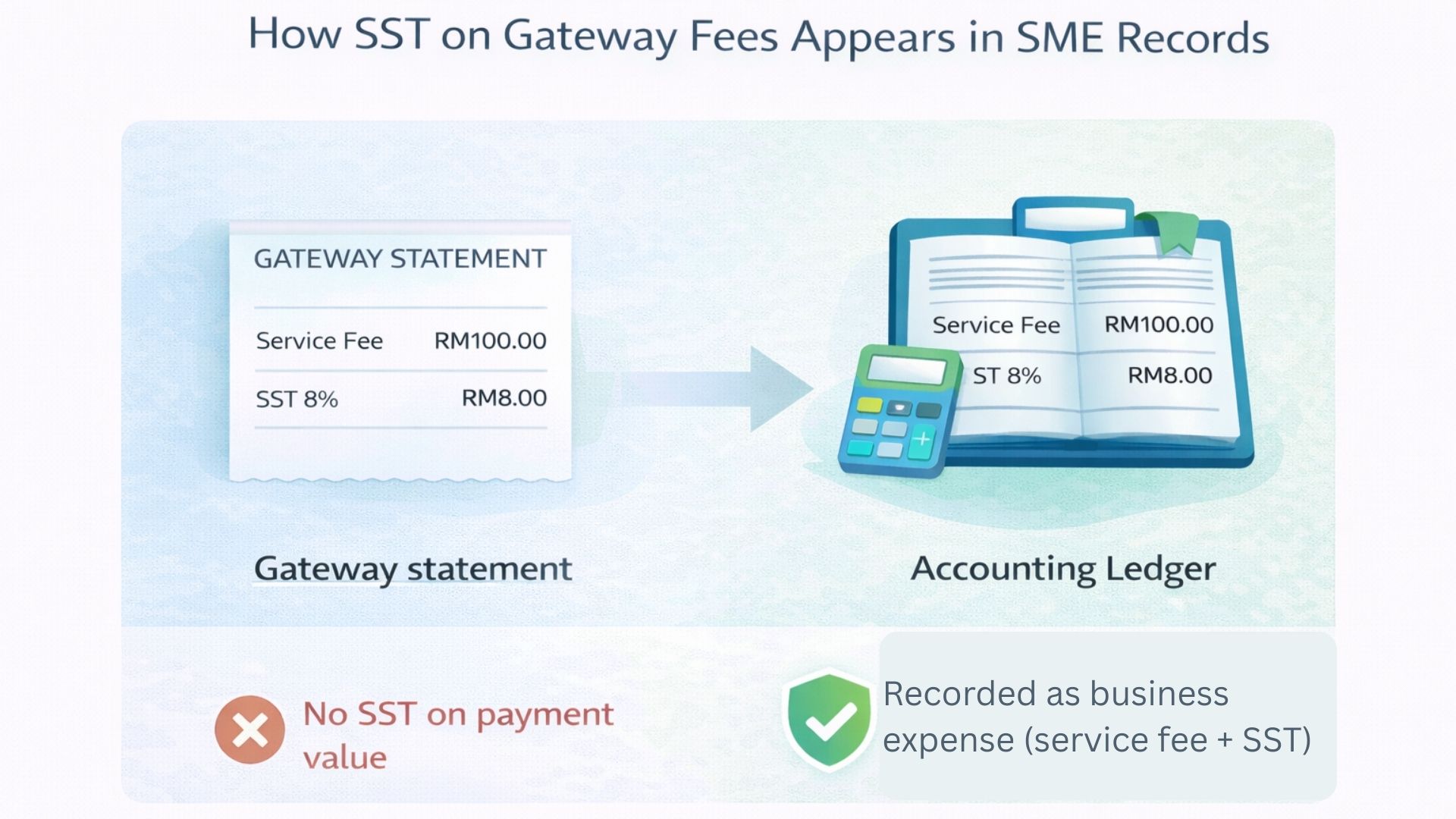

How SST Appears in Payment Gateway Statements

Different gateways present SST differently, which contributes to confusion.

Common formats include:

- SST shown as a separate line item

- SST embedded within total service fees

- Monthly consolidated SST charges

From an audit perspective, clarity matters more than format. SMEs must be able to explain:

- What portion of fees is taxable

- How SST was calculated

- How it was recorded in accounts

Relying solely on summary dashboards without proper breakdowns increases audit risk.

The image reinforces three critical compliance truths:

No SST on customer payment value

SST does not apply to what your customer pays you.

SST applies to the gateway’s service fee

The gateway is providing a taxable service to the SME.

SST must appear in your accounting records

Even if customers never see it, auditors will.

Common SST Mistakes SMEs Make With Payment Gateways

Assuming Gateway Fees Are SST-Free

Many SMEs assume digital services are exempt or already handled by the provider. This assumption is often incorrect.

Recording Gross Fees Without SST Breakdown

Lumping all gateway charges into a single expense line makes SST verification difficult later.

Treating SST as a Customer Tax

SST on gateway fees is a business service tax, not a sales tax charged to customers.

Missing SST During Reconciliation

When reconciliation focuses only on net settlements, SST charges can be overlooked entirely.

How SST on Gateway Fees Affects Accounting and Audits

From an accounting perspective, SST on payment gateway fees affects:

- Expense categorisation

- Tax reporting accuracy

- Audit traceability

Auditors typically check:

- Consistency between gateway statements and accounting records (see SST Return and Payment guide)

- Proper SST treatment on service fees

- Clear documentation supporting classifications

Poor SST handling rarely triggers immediate penalties, but it increases exposure during audits, especially when combined with other compliance gaps.

Does Your Choice of Payment Gateway Affect SST Compliance?

Indirectly, yes.

Gateways that provide:

- Clear fee breakdowns

- Consistent monthly statements

- Exportable transaction and fee data

make SST compliance easier to manage.

Gateways with opaque pricing or limited reporting force SMEs to rely on manual interpretation, which increases error risk over time.

This is one reason why SMEs evaluating choosing the right payment gateway in Malaysia should consider compliance support, not just headline fees.

How SST Fits Into the Bigger Payment Compliance Picture

SST on gateway fees does not exist in isolation.

It interacts with:

- E-Invoicing requirements

- Payment reconciliation

- Audit documentation

- Overall financial reporting accuracy

SMEs that treat payment gateways as infrastructure rather than tools tend to experience fewer surprises when regulations evolve.

Practical SST Checklist for SME Owners

SME owners should ensure that:

- Gateway service fees are reviewed for SST applicability

- SST is clearly identifiable in statements

- Accounting entries reflect SST correctly

- Records are retained for audit purposes

- Assumptions are verified with advisors when unclear

This preparation reduces last-minute corrections and compliance stress.

Final Takeaway

SST on payment gateway fees is rarely about paying more tax. It is about understanding what you are already paying and recording it correctly.

For Malaysian SMEs, clarity, documentation, and consistency matter far more than the exact fee percentage. Getting this right early makes audits smoother and keeps payment operations aligned with growing regulatory expectations.

For SMEs that prefer to work with a payment gateway provider that builds compliance, reporting, and security into its infrastructure, these considerations become increasingly important as regulations continue to develop.

Frequently Asked Questions About SST Charge on Payment Gateway Fees

Is SST charged on payment gateway transaction amounts in Malaysia?

Is SST charged on payment gateway transaction amounts in Malaysia?

No. SST is charged on the service fees imposed by the payment gateway, not on the customer’s payment or transaction value.

Who is responsible for paying SST on payment gateway fees?

Who is responsible for paying SST on payment gateway fees?

In most cases, the merchant pays SST as part of the payment gateway service cost. Customers typically do not see or pay this tax directly.

How can SMEs identify SST charges in payment gateway statements?

How can SMEs identify SST charges in payment gateway statements?

SST may appear as a separate line item or be embedded within total service fees. SMEs should review monthly statements and obtain detailed breakdowns where possible.

Is SST treatment the same for FPX and card payment gateway fees?

Is SST treatment the same for FPX and card payment gateway fees?

The payment method does not determine SST applicability. SST depends on the nature of the service fee charged by the gateway, regardless of FPX or card usage.

What happens if SST on gateway fees is recorded incorrectly?

What happens if SST on gateway fees is recorded incorrectly?

Incorrect SST recording increases audit risk and may require retrospective adjustments. While penalties are not automatic, poor documentation can raise red flags during reviews.

Should SMEs consult an accountant about SST on payment gateway fees?

Should SMEs consult an accountant about SST on payment gateway fees?

Yes. If fee structures or SST treatment are unclear, professional advice helps ensure correct classification and reduces compliance risk over time.

我们的合作伙伴 :