Merchant Benefits of Accepting AhaPay: Boost Sales & Lower Risk

- 首页

- Payments & Fintech

- Merchant Benefits of Accepting AhaPay: Boost Sales & Lower Risk

免责声明: This article is for informational and educational purposes only. It does not constitute financial, legal, or technical advice. References to any brands or gateways do not imply endorsement unless stated otherwise. Information current as of 2025 and subject to change upon Consumer Credit Act enforcement.

Why BNPL Matters Now for WooCommerce in Malaysia

先买后付(BNPL) is no longer a niche fintech product. In Malaysia, it has become a mainstream eCommerce payment method, especially among Millennials and Gen Z consumers who prefer flexibility over upfront costs.

BNPL increases the likelihood of purchase and lifts average basket sizes by around 10%. In Malaysia, there were 5.1 million active BNPL users as of December 2024, rising to 6.5 million by June 2025 (Source: Fintech News Malaysia). In 2025, Parliament passed the Consumer Credit Bill paving the way for BNPL providers to be licensed under a new Consumer Credit Commission with phased implementation from 2026, a shift that should strengthen consumer protections and market confidence.

What is BNPL in the WooCommerce Context?

BNPL lets customers split payments into instalments, usually interest-free, subject to provider terms, while the merchant receives full payment from the BNPL provider upfront. The provider then collects repayments from the customer over several weeks or months.

On WooCommerce, BNPL options can be integrated through payment gateways or plugins such as HitPay, Fiuu (formerly Razer Merchant Services), or direct providers like Atome 和 Grab PayLater. These plugins embed BNPL as a selectable option at checkout, right beside FPX, cards, and e-wallets.

This flexibility gives shoppers control over budgeting and lets small businesses offer the same convenience as larger platforms like Shopee or Lazada.

Why BNPL is Important for Malaysian WooCommerce Stores

1. Boosts Conversion and Sales

- BNPL reduces the psychological “pain of paying.” Customers perceive instalments as more affordable, which increases their likelihood to buy.

- Studies show basket sizes grow by roughly 10% when BNPL is offered.

2. Attracts New Demographics

- Younger shoppers, freelancers, and first-time credit users often prefer BNPL over traditional credit cards.

- Offering it helps WooCommerce merchants tap into segments previously excluded from credit-based payments.

3. Improves Checkout Flexibility

- BNPL complements Malaysia’s growing cashless ecosystem, where FPX transfers, DuitNow QR, and e-wallets dominate.

- By offering BNPL alongside these familiar options, you provide a complete checkout experience that feels modern and trustworthy.

4. Aligns with New Regulations

- With the Consumer Credit Bill 2025 passed, Malaysia is moving to license BNPL under a dedicated Consumer Credit Commission.

- Implementation is expected from 2026, with clear standards on conduct and disclosures, giving merchants greater confidence when choosing BNPL partners.

- Merchants remain responsible for verifying that providers are licensed under the Consumer Credit Commission once implemented.

What to Plan Before Adding BNPL to WooCommerce

1. Choose the Right Gateway

Not all payment gateways support Malaysian BNPL providers. Look for integrations that include:

- Atome (three interest-free instalments)

- Grab PayLater (pay-in-4 or pay-next-month)

- SPayLater (available via select gateways and for in-store QR; subject to provider approval)

- Fiuu (formerly Razer Merchant Services) 或 HitPay, which aggregate multiple local payment options, including BNPL

(Always review the latest provider documentation for availability, fees, and eligibility.)

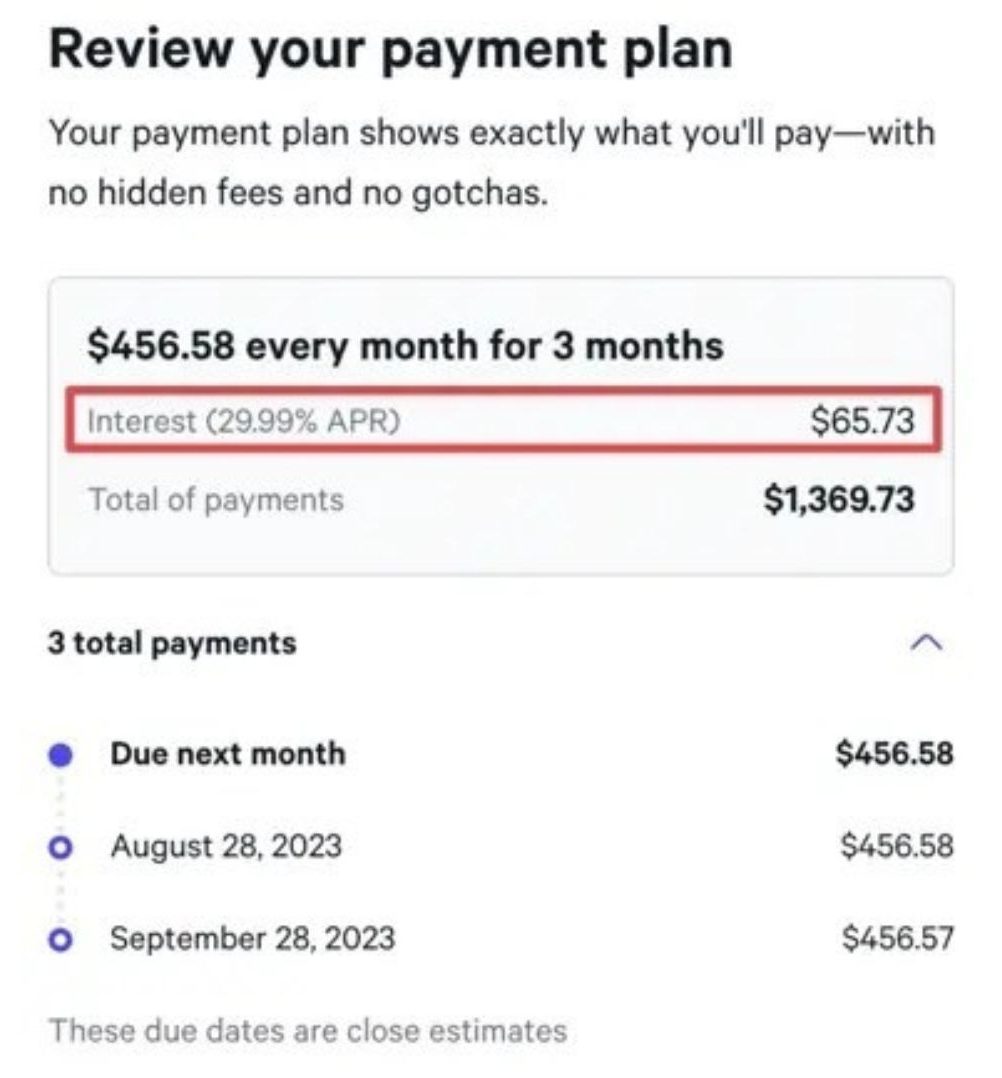

2. Ensure Checkout Transparency

Display instalment breakdowns (e.g., “RM100 × 3 payments”) near the payment selector. Use clear labels like “No interest, subject to timely repayment.” Transparency reduces chargebacks and returns.

3. Review Operations and Refund Policy

BNPL refunds can take longer because the provider needs to adjust the repayment plan. Update your return policy to reflect this timeline and train customer service staff accordingly.

4. Track Data and KPIs

Monitor:

- Conversion rate before and after BNPL

- Average order value (AOV)

- Chargebacks and refund rates

- Customer lifetime value (LTV) by payment method

This helps you understand whether BNPL adds sustainable value or only short-term spikes.

5. Maintain Compliance

Stay updated with Malaysia’s Consumer Credit framework to ensure your marketing does not mislead customers about interest-free terms or late-payment penalties. Use plain-language disclosures.

BNPL Options Available in Malaysia

| Provider | Key Features | WooCommerce Integration | Best For |

| Atome | 3 interest-free instalments; mobile-first app | Plugin via HitPay or Fiuu | Fashion, lifestyle, gadgets |

| Grab PayLater | Pay-in-4 or next-month payments within Grab app | API or gateway-based | Everyday goods, travel |

| SPayLater | Integrated with Shopee ecosystem; available via select gateways & QR in-store (eligibility applies) | Gateway-based / QR | High-volume Shopee-linked brands, omnichannel |

| Fiuu / HitPay (gateways) | Aggregate local methods incl. FPX, e-wallets, BNPL | Official WooCommerce plugins | Stores wanting multiple local pay options |

注: Details may vary by provider and are subject to change. Please confirm current terms with the respective platforms.

Misconceptions About BNPL in Malaysia

Myth 1: “BNPL is Unregulated.”

In 2025, Malaysia passed the Consumer Credit Bill to regulate non-bank credit (including BNPL) with phased licensing from 2026. Providers will require authorisation and must meet conduct standards (e.g., transparent terms and fair collections).

Myth 2: “BNPL Always Increases Profit.”

While BNPL can boost sales, fees and potential return costs can offset some gains. Model costs and margins before scaling.

Myth 3: “BNPL is Only for Luxury Products.”

BNPL adoption is growing across categories, from groceries to tech accessories, driven by affordability and convenience.

Implementation Guide: How to Add BNPL to WooCommerce

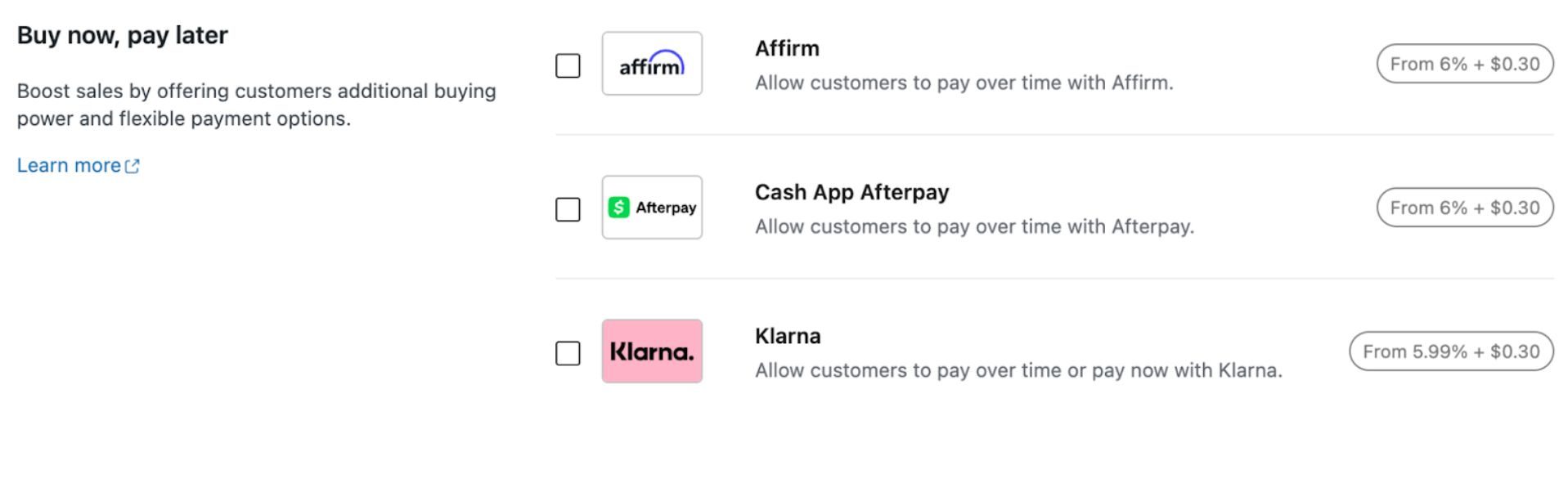

Step 1: Select a BNPL-Enabled Gateway

- Choose one with Malaysian support.

- Fiuu (formerly Razer Merchant Services) 和 HitPay are good starting points.

(Image source: WooCommerce.com)

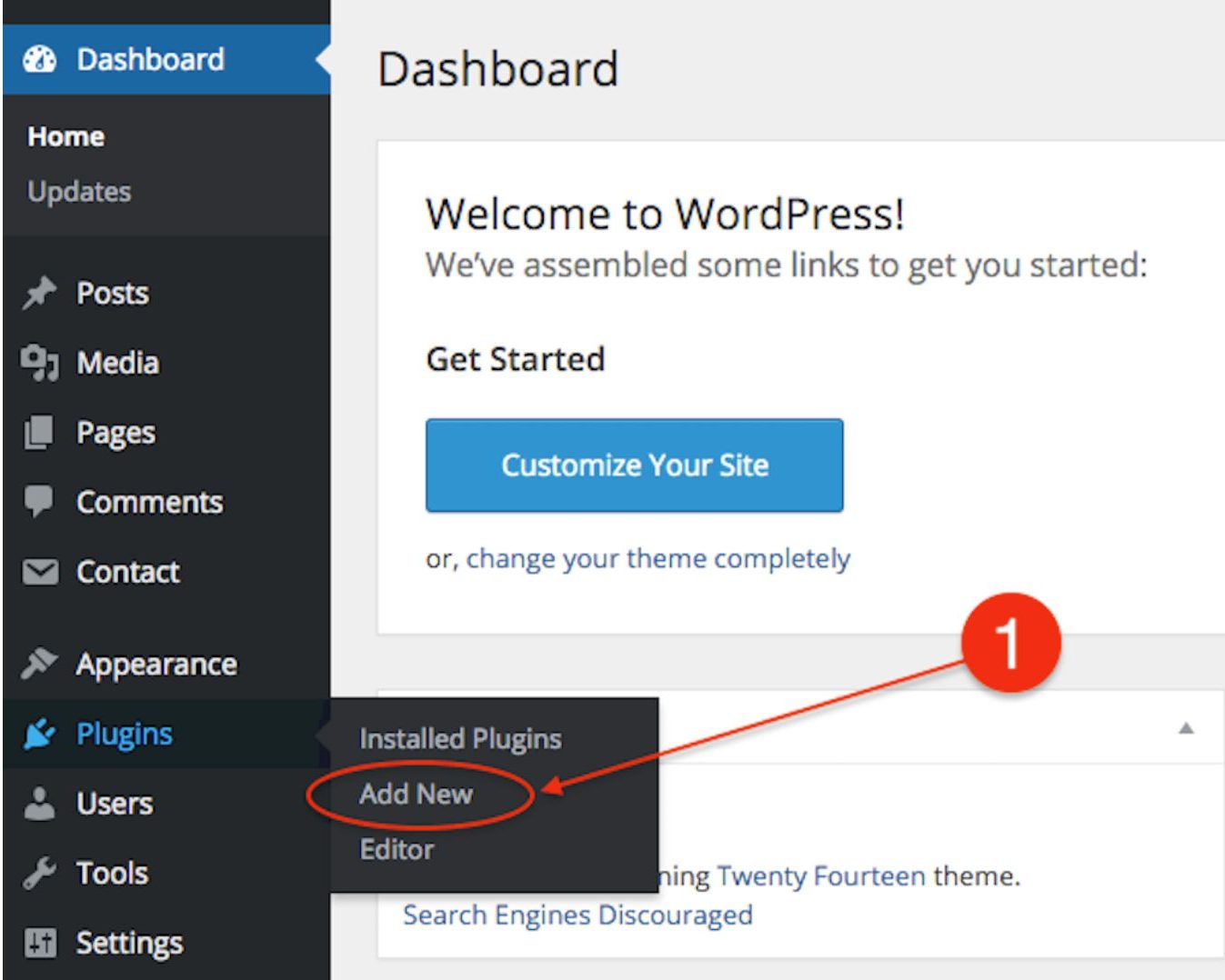

Step 2: Install the Plugin

- Use the official WooCommerce plugin from your gateway.

- Activate it and enable BNPL payment methods in your settings panel.

Step 3: Customise Checkout Experience

- Add trust badges, clear repayment terms, and interest-free labels.

- Place BNPL info both on product pages and accurate pricing labels that comply with Consumer Credit disclosure rules.

Step 4: Test Transactions

Run test orders to ensure that orders marked “paid” in WooCommerce sync properly with BNPL provider dashboards.

Step 5: Train Your Support Team

Ensure your staff understand BNPL refund timelines, dispute handling, and how to guide customers through repayment questions.

Step 6: Track and Optimise

- Measure AOV, conversion rate, and repeat purchase frequency for BNPL users.

- Use analytics to identify which cohorts yield the best ROI.

The Future of BNPL in Malaysia

Malaysia’s BNPL volumes already reached RM7.1 billion in 2H 2024 和 RM9.3 billion in 1H 2025, with continued double-digit growth expected alongside clearer rules under the Consumer Credit framework (Source: Business Today).

For WooCommerce merchants, this means BNPL is not a luxury feature but an expectation. The edge now comes from smart integration, transparent policies, and responsible messaging.

BNPL is the New Standard for WooCommerce Growth

BNPL is transforming Malaysia’s eCommerce ecosystem by bridging affordability and convenience. For WooCommerce store owners, integrating BNPL means capturing customers who value flexibility and trust.

As regulation evolves, transparency will separate responsible merchants from risky ones. Prioritise clear communication, track performance, and align with reputable BNPL providers. With thoughtful execution, BNPL can become one of your most powerful tools for conversion growth in 2025 and beyond. Partner with the right payment terminal service provider to successfully integrate BNPL tools into your business, and enjoy the growth.

Frequently Asked Questions About Buy Now Pay Later (BNPL) on WooCommerce

What is BNPL in simple terms?

What is BNPL in simple terms?

It’s a payment option allowing customers to split a purchase into instalments, usually interest-free, while merchants receive full payment upfront.

Is BNPL safe for my WooCommerce store?

Is BNPL safe for my WooCommerce store?

Yes, when you partner with reputable providers preparing for licensing under Malaysia’s Consumer Credit framework. They typically assume credit risk and handle collections, with phased rules taking effect from 2026.

Does BNPL delay merchant payouts?

Does BNPL delay merchant payouts?

Most BNPL providers settle merchants within a few business days, even though customers pay over time.

Can I combine BNPL with FPX or e-wallet payments?

Can I combine BNPL with FPX or e-wallet payments?

Yes. Many Malaysian gateways like HitPay 和 Fiuu allow multiple payment options in one checkout flow.

Does BNPL affect refund speed?

Does BNPL affect refund speed?

Refunds may take longer due to provider processing, so set clear expectations in your policy.

How do I know if BNPL is profitable?

How do I know if BNPL is profitable?

Track conversion rate, AOV, refund rate, and fee costs by payment type. The uplift in revenue should outweigh provider fees.

我们的合作伙伴 :