2026 Complete Guide to Choose Online Payment Gateway Malaysia

- Home

- Payments & Fintech

- 2026 Complete Guide to Choose Online Payment Gateway Malaysia

Disclaimer: This content is for general informational purposes only and does not constitute legal or financial advice. Payment gateway features, fees, and requirements may vary by provider. Please consult your payment service provider for specific guidance.

Choosing a payment gateway in Malaysia can feel overwhelming. With so many providers offering different fees, settlement cycles, and features, it is important to know what matters most for your business.

This guide breaks everything down clearly so you can choose the right payment solution whether you’re running an online store, a physical shop, or both.

1. Understand the Payment Methods Your Customers Use

Not all gateways support the same payment channels. Before choosing a gateway provider, check what your customers prefer to pay with.

Common payment methods in Malaysia:

- FPX Online Banking

- DuitNow QR

- Credit/Debit Cards (Visa, Mastercard)

- Local e-wallets (TnG, GrabPay, Boost, ShopeePay)

- Buy Now Pay Later (BNPL) (Atome, AhaPay, PayLater)

- International wallets (Alipay+, WeChat Pay, GCash, etc.)

- Recurring payments / subscription billing

- Instalment or split payments

Trends in Malaysia

- Bank Negara Malaysia Annual Report 2023 notes high adoption of online banking and FPX for e-commerce transactions, with QR payments, including DuitNow QR, showing steady uptake across the country.

- PPRO Malaysia reports strong usage of bank transfers and cards in Malaysia’s online payment mix.

Practical examples

- Online shoppers → FPX + Cards

- F&B and Retail → DuitNow QR + Cards

- Tourists or cross-border customers → Alipay+, WeChat Pay

2. Compare Pricing & Fees Transparently

Payment gateway fees in Malaysia differ based on method and provider. Always check each cost component.

Core fees to review:

- FPX fee

- Card fee (credit/debit)

- E-wallet fee

- DuitNow QR fee

- Refund fee

- Chargeback fee

- Settlement fee (if any)

- Monthly fee/ annual fees

- Terminal rental fee (if using a POS terminal)

Typical fee ranges in Malaysia

Fees typically vary by provider. For example, some gateways charge:

- FPX: RM0.60 – RM1.00

- Cards: 1.8% – 3.2% per transaction

- E-wallets: 1.5% – 3.0%

- DuitNow QR: 0% – 0.5% (sometimes RM0 during promos)

*Actual fees may vary, so always check the latest rates with your chosen provider.

Tip: Do not choose a gateway solely based on the lowest fee. Consider settlement speed, reliability, and hidden charges.

3. Check Settlement Speed (Your Cash Flow Depends On It)

A gateway’s payout cycle directly affects liquidity and operations.

Common settlement timelines:

- T+0 (same-day settlement)

- T+1 (next business day)

- T+2 to T+3

- Weekly (rare, but some low-cost providers use this)

Settlement timelines vary by provider, acquirer, operational cut-off times, merchant risk tier, and industry category.

Why this matters:

- F&B and retail businesses often prefer T+0/T+1 for daily operational cash.

- E-commerce sellers who restock frequently benefit from faster turnaround.

- Businesses with tight margins should avoid slow settlement structures.

4. Look at the Dashboard, Reporting & Reconciliation Tools

A strong backend helps you manage and understand your sales.

Look for:

- Real-time dashboard

- Downloadable reports (CSV/Excel)

- Refund management

- Chargeback tools

- Settlement tracking

- Payout history

- Reconciliation capabilities

Tip: Ask the provider for a dashboard demo before you onboard.

5. Check Integration & Developer Support

For online businesses, technical flexibility is crucial.

Must-have technical features:

- REST API

- Webhooks

- Sandbox/testing environment

- WooCommerce/Shopify/Magento/PrestaShop plugins

- Mobile SDKs (iOS/Android)

- Hosted checkout page

- Payment links

Tip: A clean, modern API saves developers days or weeks of effort.

6. Review Security, Compliance & Risk Controls

Security is non-negotiable. Choose a provider that is:

- Licensed or approved by Bank Negara Malaysia (BNM), where applicable

- FPX participating acquirer or provider integrated with FPX

- PCI-DSS compliant for card transactions

- Equipped with fraud screening, risk scoring, and monitoring tools

Why this matters

Poor fraud controls may increase the likelihood of issues such as:

- Higher chargebacks

- Temporary payout holds

- Fund reserves

- Account suspension

Note: Read the T&Cs carefully especially around settlement, chargebacks, and reserves.

7. Evaluate Customer Support (Many SMEs Overlook This)

When payments fail, support speed directly impacts customer satisfaction and revenue.

Questions to ask:

- Do they provide WhatsApp/phone/email support?

- Is support available outside office hours?

- How fast is their response time?

- Do they have local support in Malaysia?

- Do they assist with onboarding and integration?

Tip: Good support can save you revenue during technical issues.

8. If You Run a Physical Store, Consider a POS / Terminal Options

Retail and F&B businesses may need terminals such as:

- Android POS

- QR-only terminal

- Card reader

Check for:

- Terminal cost

- Warranty

- Stability & network reliability

- Battery life

- Support for all local QR/e-wallets

- Any recurring subscription/rental fees

9. Compare Value-Added Features

Modern payment companies offer more than just payment acceptance.

Look for features that improve cash flow or operations:

- Same-day settlement

- Embedded financing/ merchant cash advance

- Payout automation

- Invoice management tools

- QR ordering / e-menu system

- E-commerce storefront builder

- Virtual terminal for phone orders

These can reduce manual work and improve efficiency.

Shortlist the Gateways Based on Your Business Type

If you are a startup with low volume:

- Choose a gateway with low setup cost and no monthly fee.

If you run e-commerce with moderate volume:

- Prioritize FPX fees, card fees, and settlement speed.

If you run high-volume F&B or retail:

- Look for a provider with a reliable terminal + QR support.

- Ensure fast payout and easy reconciliation.

If you serve international customers/tourists:

- Choose a gateway with Alipay+, WeChat Pay, and multi-currency support.

If you want financing options:

- Select a gateway that offers merchant cash advances or revenue-based financing.

Final Decision Checklist

Before choosing, evaluate this:

| Criteria | Yes/No |

| Supports all required payment methods | ☐ |

| Transparent pricing | ☐ |

| Fast settlement | ☐ |

| Good dashboard & reporting | ☐ |

| Easy integration / plugins | ☐ |

| Strong security & BNM compliance | ☐ |

| Good customer support | ☐ |

| Supports terminals (if needed) | ☐ |

| Offers value-added services | ☐ |

| Fits my business type | ☐ |

If a provider meets most of these criteria, it is usually a good sign.

Tips: Always compare at least 3–5 gateways before deciding.

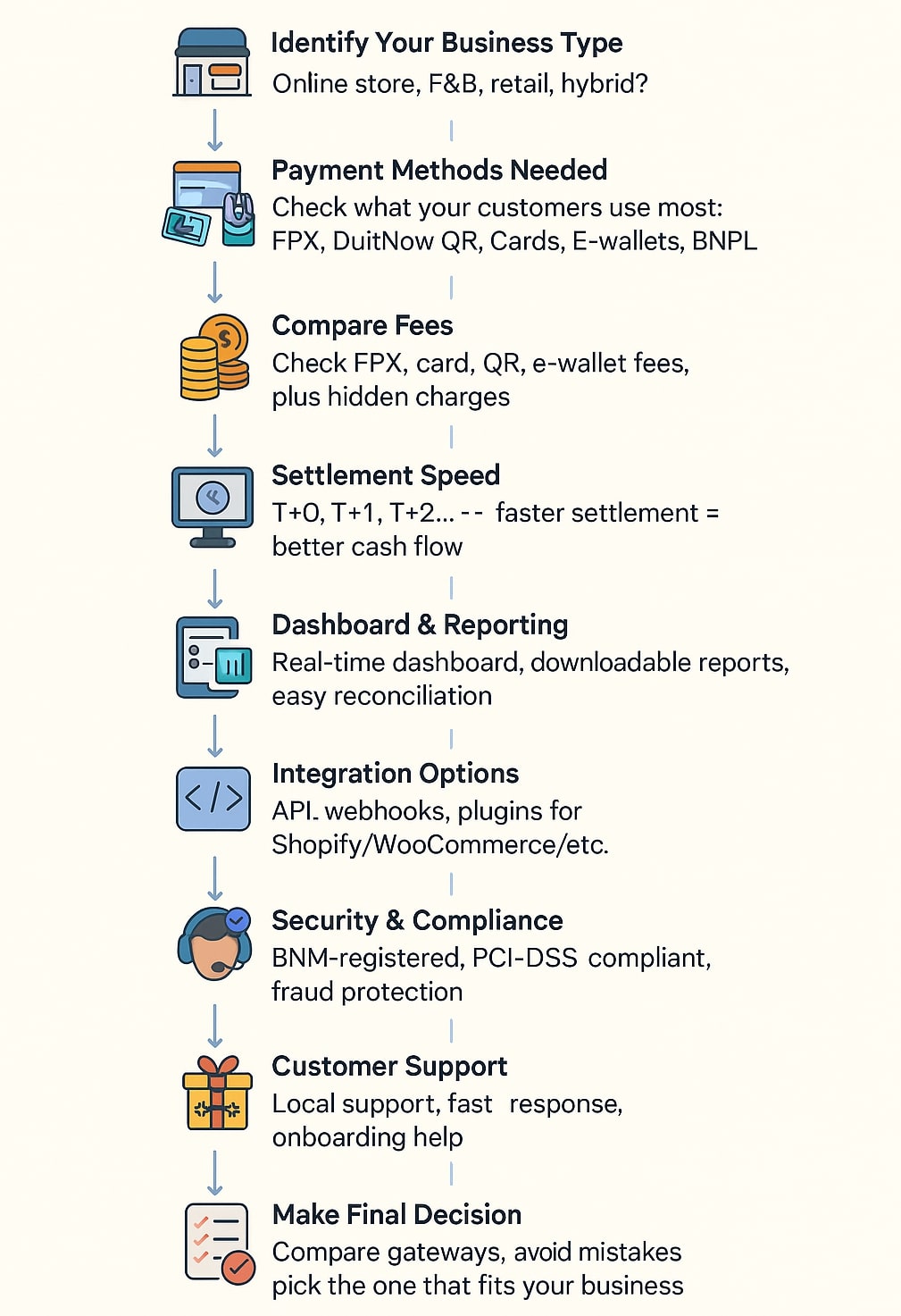

Quick recap on steps on choosing online payment gateway:

Conclusion

Choosing an online payment gateway in Malaysia requires balancing fees, payment methods, settlement speed, support quality, integration, compliance, and your specific business needs.

With the right provider, payments operations become smoother, cash flow improves, and customer experience gets better.

Frequently Asked Questions About How to Choose Online Payment Gateway Malaysia

What is an online payment gateway in Malaysia?

What is an online payment gateway in Malaysia?

An online payment gateway is a service that allows businesses in Malaysia to accept digital payments such as FPX, DuitNow QR, cards, and e-wallets securely through websites, apps, or POS systems.

Which payment methods should a Malaysian payment gateway support?

Which payment methods should a Malaysian payment gateway support?

Most online payment gateways in Malaysia should support FPX online banking, DuitNow QR, credit and debit cards, major local e-wallets, and optional methods like BNPL or international wallets if relevant.

How much does an online payment gateway cost in Malaysia?

How much does an online payment gateway cost in Malaysia?

Costs vary by provider and payment method. Typical fees include FPX charges, card transaction percentages, e-wallet fees, and possible setup or terminal fees. Always review the full fee structure before signing up.

Why is settlement speed important when choosing a payment gateway?

Why is settlement speed important when choosing a payment gateway?

Settlement speed affects cash flow. Faster payouts such as T+0 or T+1 are especially important for retail, F&B, and e-commerce businesses that rely on daily operating capital.

Is Bank Negara Malaysia (BNM) approval important for payment gateways?

Is Bank Negara Malaysia (BNM) approval important for payment gateways?

Yes. Choosing a payment gateway that is licensed, registered, or compliant with Bank Negara Malaysia helps ensure regulatory compliance, payment stability, and better protection against fraud or payout issues.

How do I choose the best payment gateway for my business type?

How do I choose the best payment gateway for my business type?

The best choice depends on your business model. E-commerce businesses should prioritise FPX and card fees, retail stores should focus on QR and terminal support, and international-facing businesses should look for multi-currency and cross-border options.

Recent Posts

- 2026 Complete Guide to Choose Online Payment Gateway Malaysia

- Setting Up a Payment Gateway on Shopify (Malaysia & Beyond)

- Shopify Malaysia: Payment Gateway Problems You Should Know

- The Future of Payments: How APIs Are Powering Malaysia’s Cashless Economy

- WooCommerce vs Shopify for SMEs: Which Handles Payments Better?

Categories

Our Partners :

Paydibs is a leading payment solutions provider committed to simplifying transactions for businesses of all sizes.