What Auditors Look for in Payment Gateway Records (Malaysia)

- Home

- Payments & Fintech

- What Auditors Look for in Payment Gateway Records (Malaysia)

Disclaimer: This content is for general informational purposes only and does not constitute legal, tax, accounting, or financial advice. Readers should consult qualified professionals for advice specific to their business circumstances.

For Malaysian Small and Medium Enterprise (SME)s, audits may occur for many reasons, including routine reviews, financing requirements, regulatory checks, or internal governance processes.

When audits involve financial records, payment gateway data is commonly reviewed. This is because transactions processed through a business payment app are closely linked to revenue recognition, expense recording, tax treatment, and cash settlement.

This guide explains how payment gateway records are typically reviewed during audits, what auditors tend to examine first, which documents are commonly requested, and how SMEs can organise records to support a smoother review process.

Why Payment Gateway Records Matter During Audits

Payment gateway records are often examined because they provide an independent source of transaction data.

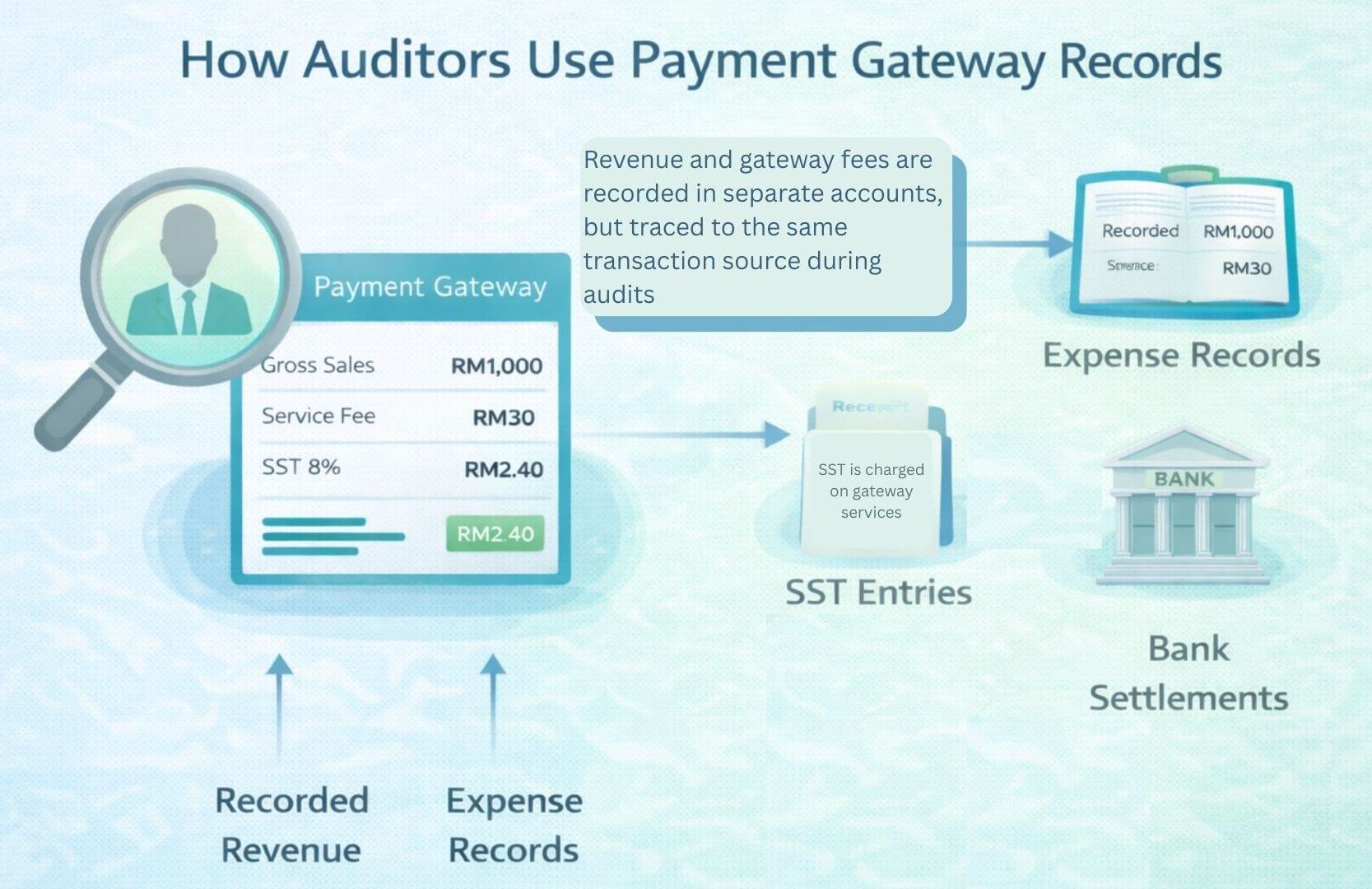

From an audit perspective, gateway records help support:

- Completeness of recorded revenue

- Accuracy of recorded expenses

- Correct treatment of Sales and Services Tax (SST) on service fees

- Consistency between transaction activity and bank settlements

Because payment gateways sit between customers and bank accounts, they are frequently used as a reference point to validate other financial records. They allow auditors to cross-check what customers paid, what fees were charged, and what funds were eventually settled into the bank.

This is why gateways are reviewed even when no issues are suspected.

The Core Areas Auditors Commonly Review

Auditors usually start with high-level consistency checks before drilling deeper.

Revenue Completeness

Auditors typically assess whether transactions processed through the payment gateway are fully reflected in revenue records.

This may involve comparing:

- Gateway transaction summaries

- Sales records or invoices

- Reported revenue figures

Differences are not uncommon, but unexplained gaps usually require clarification.

Fee Accuracy

Payment gateway fees are reviewed to determine whether they are:

- Recorded separately from revenue

- Categorised consistently as expenses

- Supported by gateway documentation

SST Treatment

SST related to payment gateway service fees is another common review area.

Auditors may check whether:

- Where the gateway fee is a taxable financial service, SST is applied to the gateway’s service fee (not the customer’s transaction value).

- SST on gateway fees is recorded correctly as part of the service cost.

- Accounting entries for SST and service fees align with the gateway’s statements.

Under RMCD’s Guide on Financial Services (Service Tax 2018), most merchant-facing gateway charges are taxable fee-based financial services. However, certain switching or transaction fees between banks and payment gateways that are directly linked to current, savings or similar e-wallet accounts may fall under basic banking services and are excluded from service tax. Clarifications on these scenarios are discussed further in the section on SST on payment gateway fees in Malaysia.

Settlement Timing

Auditors also consider timing differences between:

- Transaction dates

- Settlement dates

- Accounting periods

Differences are expected, particularly where settlements occur on a delayed basis. The focus is usually on whether these differences are understood and documented.

Documents Auditors Commonly Request

Audit queries often relate more to documentation availability than to calculation errors.

Commonly requested documents include:

Payment Gateway Statements

Statements showing transaction totals, fees, SST, refunds, and adjustments.

Settlement Reports

Reports detailing amounts settled to bank accounts and settlement timing.

Bank Statements

Used to confirm settlement amounts and reconcile cash movement.

Invoices and Refund Records

Used to support revenue recognition and reversal treatment.

Clear documentation generally helps reduce follow-up questions.

Patterns That May Lead to Additional Questions

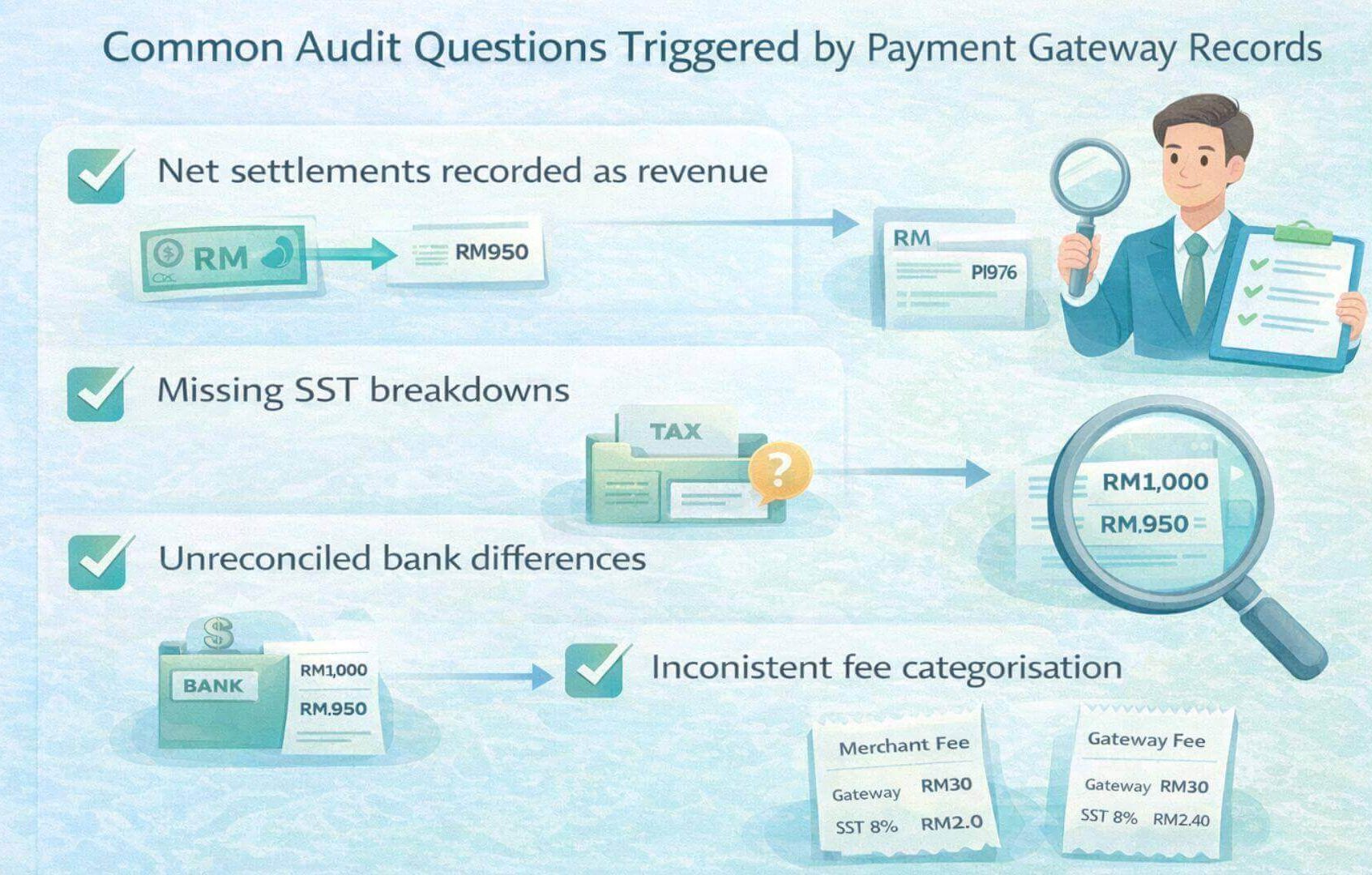

Certain record-keeping practices tend to result in additional audit enquiries.

These may include:

- Recording only net settlement amounts as revenue

- Inconsistent expense categorisation across periods

- Missing or unclear SST breakdowns

- Differences between gateway reports and bank statements without explanation

- Manual adjustments without supporting notes

These situations do not automatically indicate errors, but they often require clarification.

How SMEs Can Organise Records Ahead of an Audit

From a practical standpoint, audit preparation focuses on organisation and consistency.

Common preparatory steps include:

- Retaining gateway statements for each reporting period

- Recording gross revenue and gateway fees separately

- Ensuring SST amounts can be identified

- Reconciling gateway data with bank settlements

- Documenting timing differences where applicable

- Maintaining records for refunds and chargebacks

How Payment Gateway Reporting Can Affect Audit Effort

While audits do not assess the commercial merits of a payment gateway, the format and clarity of gateway reports can influence the amount of time needed to review records.

Gateways that provide:

- Consistent reporting formats

- Clear fee and SST breakdowns

- Exportable transaction data

can make reconciliation and review more straightforward.

For this reason, record-keeping considerations are often part of discussions around choosing the right payment gateway in Malaysia, alongside operational and cost factors.

Conclusion for SME Owners

Audit reviews of payment gateway records are generally focused on consistency, traceability, and documentation.

For Malaysian SMEs, maintaining clear records that separate revenue, fees, taxes, and settlements helps support smoother audit discussions and reduces the need for repeated clarification.

Where reporting, documentation, and reconciliation processes are clearly defined, audits tend to focus on verification rather than investigation.

FAQs About What Auditors Review in Payment Gateway Records

Why do auditors review payment gateway records during audits?

Auditors review payment gateway records because they provide an independent transaction trail that supports revenue completeness, expense accuracy, tax treatment, and cash settlement verification.

Do auditors check payment gateway records even if there are no issues?

Yes. Payment gateway records are commonly reviewed as part of routine audit procedures, especially when they are a primary source of customer payments.

What payment gateway information do auditors focus on first?

Auditors typically focus on transaction totals, fee accuracy, SST treatment on service fees, and whether settlement amounts reconcile with bank records.

Are net settlement figures acceptable for audit purposes?

Net settlement figures alone are usually insufficient. Auditors generally expect to see gross transaction values and separate records for fees and taxes.

How far back do auditors usually request payment gateway records?

This depends on the audit scope, but auditors often request records covering the current financial year and may ask for prior periods if inconsistencies are identified.

Can poor payment gateway records delay an audit?

Yes. Missing statements, unclear fee breakdowns, or unreconciled differences can extend audit timelines while additional explanations or documents are requested.

Categories

Our Partners :

Paydibs is a leading payment solutions provider committed to simplifying transactions for businesses of all sizes.