How to Record Payment Gateway Fees in Your Accounts (Malaysia Guide)

- Home

- Payments & Fintech

- How to Record Payment Gateway Fees in Your Accounts (Malaysia Guide)

Disclaimer: The information provided is general in nature and may not apply to all business situations. For accurate accounting and tax treatment, consult a qualified accountant or tax professional.

Recording payment gateway fees correctly is one of the most overlooked accounting tasks among Malaysian Small and Medium Enterprise (SME)s. Many businesses process hundreds or thousands of transactions each month, yet rely on rough summaries or net settlement figures when updating their books.

This approach works until it does not. During audits, tax reviews, or financial reporting, payment gateway fees often become a source of reconciliation gaps, Sales and Services Tax (SST) errors, and unnecessary follow-up questions.

This guide explains what counts as a payment gateway fee, how it should be recorded in SME accounts, how SST fits into the entries, and what auditors typically expect to see during reviews.

Why Payment Gateway Fees Are Often Recorded Incorrectly

Most SMEs do not intentionally record gateway fees wrongly. The issue usually comes from how payment data is presented.

Common reasons include:

- Gateway dashboards prioritise transaction flow, not accounting clarity

- Net settlement amounts hide underlying fees and SST

- Different payment methods are bundled together

- Monthly summaries lack detailed breakdowns

As a result, SMEs often record only what arrives in the bank, not what was actually charged.

What Counts as a Payment Gateway Fee

Before recording anything, it is important to understand what qualifies as a gateway fee.

Typical Components of Payment Gateway Charges

Most gateways charge for:

- Transaction or processing fees

- Service or platform fees

- Settlement or handling fees

- Optional security or fraud-related services

- SST on the service portion, where applicable

These charges are separate from:

- Customer payment amounts

- Sales revenue

- Refund values

From an accounting perspective, gateway fees are business service expenses, not reductions in revenue.

Why Net Settlement Amounts Should Not Be Used as Revenue

A common shortcut is to treat the net amount received in the bank as revenue. This creates distorted financial records.

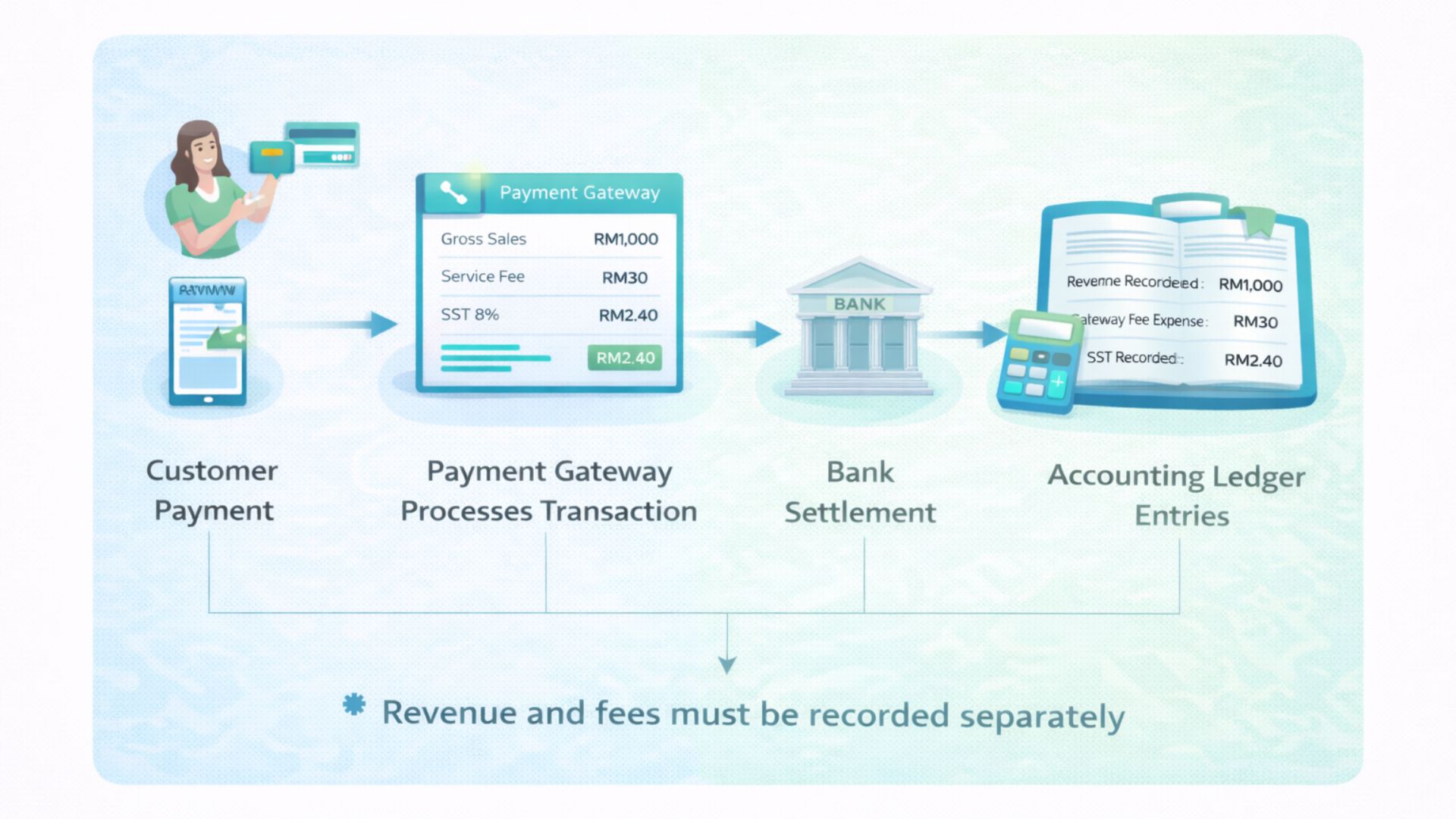

Example:

- Customer pays RM1,000

- Gateway deducts RM30 in fees

- Bank receives RM970

Correct treatment:

- Revenue recorded: RM1,000

- Payment gateway fees recorded: RM30 as an expense

Recording RM970 as revenue understates income and masks actual costs.

How to Record Payment Gateway Fees in SME Accounts

At a practical level, the recording logic is straightforward.

Step 1: Record Gross Sales Revenue

Sales revenue should reflect the full amount paid by customers, regardless of gateway deductions.

Step 2: Record Payment Gateway Fees as Expenses

Gateway fees should be recorded as operating expenses under categories such as:

- Payment processing fees

- Merchant service fees

- Financial service charges

Step 3: Match Fees to the Correct Period

Fees should be recorded in the same period as the transactions they relate to, even if settlement occurs later.

This ensures accurate profit reporting.

How SST on Payment Gateway Fees Should Be Recorded

SST treatment on payment-gateway fees is understandably confusing, especially after the 2025 changes to financial services.

Under the Service Tax Act 2018 and RMCD’s Guide on Financial Services, payment-related charges work broadly as follows:

1. When is SST charged?

In Malaysia, SST is charged on the payment gateway’s service fee, not on the customer’s purchase amount.

However, not all payment-related fees are subject to SST.

Some charges are treated as basic banking services (for example, certain fees on transfers or payments linked to current/savings accounts or e-wallets).

These basic banking services are not subject to SST based on the RMCD Guide on Financial Services.

So, whether SST applies depends on what type of service the gateway or bank is providing.

2. How should a merchant record this?

From the merchant’s point of view (the business using the payment gateway):

The payment gateway fee is recorded as an expense.

Any SST on that fee (if the fee is taxable) is recorded as part of the cost of that service. There is no input tax credit under SST like there was under GST.

SST is not revenue for the merchant.

The gateway charges SST (if applicable) and pays it to RMCD.

The merchant simply bears this as a cost. If the merchant adds a “processing fee” to customers to cover this cost, that fee is normal business income, not SST.

Reminder: Whether SST applies can depend on the exact structure of the payment flow and service. For specific cases, check the latest RMCD guides or speak to a tax professional.

Does Accounting Treatment Differ for Financial Process Exchange (FPX) and Card Payments?

From a revenue and expense perspective, no.

Whether the payment is via payment app, FPX, card, or e-wallet:

- Gross sales are recorded the same way

- Gateway fees are recorded as expenses

- SST applies to the service fee where relevant

The difference lies in:

- Fee structure

- Reporting detail

- Compliance and security obligations

These distinctions affect reconciliation and compliance, not basic accounting treatment.

Common Accounting Mistakes Auditors Flag

Auditors frequently identify the same issues across SMEs.

Recording Only Net Settlements

This hides actual expenses and misstates revenue.

Combining Gateway Fees With Bank Charges

Payment gateway fees are service expenses, not bank fees.

Ignoring SST on Gateway Services

Missing SST entries raise red flags during reviews.

Inconsistent Reconciliation

When gateway reports, bank statements, and ledgers do not align, auditors will ask why.

What Good Payment Gateway Records Look Like During an Audit

Well-prepared SMEs usually have:

- Clear separation between revenue and fees

- Monthly gateway statements retained

- SST clearly identifiable

- Consistent reconciliation between gateway, bank, and ledger

This level of clarity reduces audit time and follow-up queries. Audit expectations may vary based on the nature and scale of the business, and companies are expected to maintain appropriate documentation in line with statutory requirements.

How Payment Gateway Choice Affects Accounting Effort

While accounting principles remain the same, some gateways make compliance easier.

Gateways that provide:

- Clear monthly statements

- Fee and SST breakdowns

- Exportable transaction data

reduce manual accounting work and error risk.

This is why accounting teams are often involved when businesses evaluate choosing the right payment gateway in Malaysia, not just pricing or features.

Final Takeaway for Malaysian SME Owners

Recording payment gateway fees correctly is not about complex accounting rules. It is about visibility, consistency, and discipline.

By separating revenue from fees, recognising SST properly, and maintaining clear records, SMEs avoid distorted financials and unnecessary audit stress.

For businesses that work with a payment gateway provider that is compliance aware, and data clarity into its infrastructure, maintaining clean accounts becomes significantly easier as transaction volume grows.

FAQs About How to Record Payment Gateway Fees

Where to put payment gateway fees in accounts?

Payment gateway fees should be recorded as operating expenses, usually under categories such as payment processing fees, merchant service fees, or financial service charges. They should not be netted off against sales revenue.

Are payment gateway fees considered a cost of sales or an operating expense?

In most SME setups, payment gateway fees are treated as operating expenses rather than cost of sales. This keeps revenue reporting accurate and avoids understating gross income.

Should payment gateway fees be recorded before or after bank settlement?

Fees should be recorded based on the transaction period they relate to, not just when funds are settled into the bank. This ensures proper matching of revenue and expenses.

How should SST on payment gateway fees be recorded in accounts?

SST on payment gateway fees should be recorded as part of the service expense. It is not revenue and is not charged to customers, but must be clearly identifiable in accounting records.

Is accounting treatment different for FPX, card, or e-wallet payments?

No. Regardless of payment method, gross revenue should be recorded in full and gateway fees recorded separately as expenses. Differences mainly affect reporting detail, not accounting principles.

What accounting mistakes do auditors commonly find with payment gateway fees?

Auditors often flag netting fees against revenue, missing SST entries, inconsistent reconciliation between gateway statements and bank records, and lack of supporting documentation.

Recent Posts

- How to Reduce Online Payment Failures: 10 Common Causes & Fixes

- Paydibs – AltPayNet Partnership Advances Financial Connectivity and Inclusion Between Malaysia and the Philippines

- How to Record Payment Gateway Fees in Your Accounts (Malaysia Guide)

- Paydibs Strengthens Inclusive Innovation with Nexus E-Commerce Suite and Mini POS Feature for Malaysian MSMEs

- E-Invoicing in Malaysia: How Payment Gateways Fit In

Categories

Our Partners :

Paydibs is a leading payment solutions provider committed to simplifying transactions for businesses of all sizes.